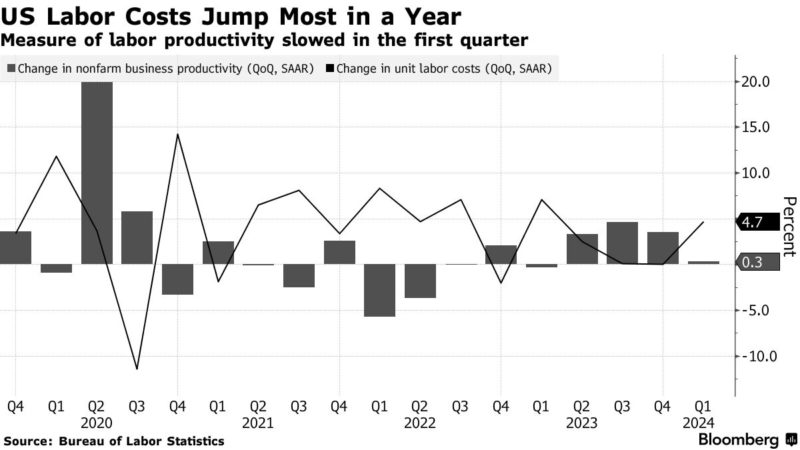

US labor costs increased in the first quarter by the most in a year as productivity gains slowed, potentially adding to risks inflation will remain elevated.

Unit labor costs, or what a business pays employees to produce one unit of output after taking into account changes in productivity, climbed at a 4.7% annual rate. That marked a notable jump after muted gains in the second half of 2023.

Productivity, or nonfarm employee output per hour, rose at a 0.3% annualized rate after an upwardly revised 3.5% gain in the prior period, data from the Bureau of Labor Statistics showed Thursday.

The median forecast in a Bloomberg survey of economists called for a 4% increase in labor costs and a 0.5% rise in productivity. Labor costs have typically jumped in the first quarters of recent years, though they tended to moderate in subsequent periods.

While quarterly productivity figures are quite volatile, a sustained slowdown would represent another hurdle for the Federal Reserve’s inflation fight. With interest rates expected to stay at a two-decade high for awhile longer, business investment in equipment will likely continue to be a weak factor in overall economic growth.

The Thursday figures corroborate other data that showed gross domestic product cooled in the first quarter while employment costs rose by the most in a year. As a result, inflation is proving stubborn, supporting the Fed’s pivot to a more hawkish stance that will keep interest rates higher for longer than anticipated.

Chair Jerome Powell, speaking after the central bank’s policy meeting Wednesday, said it’s hard to judge whether the robust productivity gains seen in 2023 will endure. He’s previously said that an increase in immigration can support economic growth without adding to inflation, and the influx has also been shown to enhance productivity.

The report showed output rose at a 1.3% pace in the first quarter from the prior three-month period — the smallest advance since a decline nearly two years ago — while hours worked increased 1%. As a result, hourly compensation growth advanced 5% from the previous quarter, the most in almost a year.

Last week, the BLS corrected quarterly and annual productivity figures, along with hours worked figures, for the past five years. In recent quarters, the data were generally off by a tenth of a percent or two, if at all, while the changes during the first year of the pandemic were much larger.

Separately, initial applications for unemployment benefits, as well as continuing claims, were unchanged in the latest periods at historically low levels. Another report from Challenger, Gray & Christmas, Inc. indicated layoff announcements fell in April from a year earlier.

“As labor costs continue to rise, companies will be slower to hire, and we expect further cuts will be needed. This low April figure may be the calm before the storm,” said Andrew Challenger, the firm’s senior vice president.

The data precede Friday’s jobs report, which is forecast to show employers moderated hiring in April while monthly wage gains held steady.

Source: bloomberg.com